Ratings have existed for nearly 180 years! When the United States started expanding westward, so did the trading distance between merchants and their customers. Merchants were reluctant to extend credit to new and unfamiliar customers, for fear of non-payment. This then led to the birth of mercantile agencies - the precursors of today’s rating agencies. These agencies assessed the merchants’ abilities to repay their debts and published the assessment results in a guide. The first such agency was founded in 1841, in the wake of the American financial crisis of 1937 that had triggered a major depression with plunging prices, profits and wages – not unlike the recession we are facing today.

The basic functions of ratings have not changed much since then. Ratings bridge the information gap between buyers and sellers in transactions. Whether for physical goods or intangible services, and be it B2B or B2C, each party in a transaction is keen to protect their respective interests. In today’s financial world, various actors assume the role of the information intermediary. Banks perform this role in banking transactions, while credit bureaus issue credit scores to individuals in B2C transactions. In the context of a B2B or disintermediated financial transaction (such as a bond issue), rating agencies provide information which, in turn, increases transparency, efficiency and liquidity for the market.

This is exactly the reason why a transparent and well supervised jurisdiction like Labuan IBFC would welcome a bespoke rating service for all license holders, not only to evidence its well-regulated marketplace but, just as importantly, to encourage intra Labuan IBFC business amongst its burgeoning cohort of license holders.

“Labuan IBFC is now home to nearly 900 license holders, and we realise that a competitive yet tailored rating service for the jurisdiction would be an ideal springboard to increase intra Labuan business,” said Farah Jaafar-Crossby, CEO Labuan IBFC Inc, the market development agency for the jurisdiction.

Farah added that the benefit of having an independent assessment should never be underestimated as the trust a rating evokes is able to open numerous business opportunities, allowing potential counterparties and partners an unbiased insight into the strength of Labuan licensees. If history is any guide, each crisis in the past has proven that timely information is critical to overcome uncertainties; this will be no different in the post-COVID era.

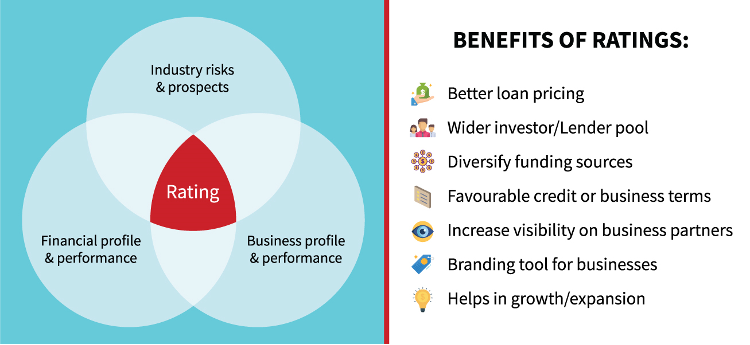

A rating may address specific or general financial obligations (an entity’s ability to pay or risk of default). In a wider context, it may also apply to performance or servicer obligations. A typical rating considers not just an entity’s financial information, but also the business and industry risks as well as management credentials, which a credible and experienced rating agency will be able to assess objectively.

Ratings offer an independent evaluation of a company’s risk profile

LECA™ is RAM’s bespoke new rating service to evaluate the performance and financial standing of Labuan entities. LECA™ encapsulates the global wholesale nature of licensees’ business and financial dealings in Labuan IBFC while adhering to RAM’s established framework for risk assessment.

RAM will be conducting a series of webinars in April 2021 on LECA™. Registration is free on a first-come, first-served basis. Click on any link to register.

For (Re)Insurance, (Re)Takaful, Captives & PCC | Tuesday, 13 April 2021 at 3:00 PM (GMT +8), click here.

For Service Providers (Trust Companies, Insurance Managers & Brokers) | Wednesday, 14 April 2021 at 11:00 AM (GMT +8), click here.

For Commercial & Investment Banks | Thursday, 15 April 2021 at 11:00 AM (GMT +8), click here.

Or visit https://www.ram.com.my/LECA for more information.

Established in 1990 by Malaysia's central bank, RAM Ratings is the leading credit rating agency in Malaysia and Asia. We deliver independent insights and opinions to support confident decisions in financial markets. Our rating expertise covers corporate, bank and non-bank financial institutions, project and structured finance, and Islamic finance. We also provide country risk, macroeconomic and topical research in addition to risk analytics and solutions for credit risk and other related areas.