“HEIR IN THE CLOUD, wealth that counts to leave a lasting legacy”

Importance of Wealth Planning

- Malaysians are becoming more and more affluent – concept is new/unfamiliar

- Engaging in cross-border activities/transactions and assets may be held as security

- Increase in family-run businesses – multiple parties/generation

- Desire for patriarchs and matriarchs of family businesses to decide the way forward

- Increase in family feuds - disputes/decrease in value of business

Wealth planning through modern structures via Labuan IBFC

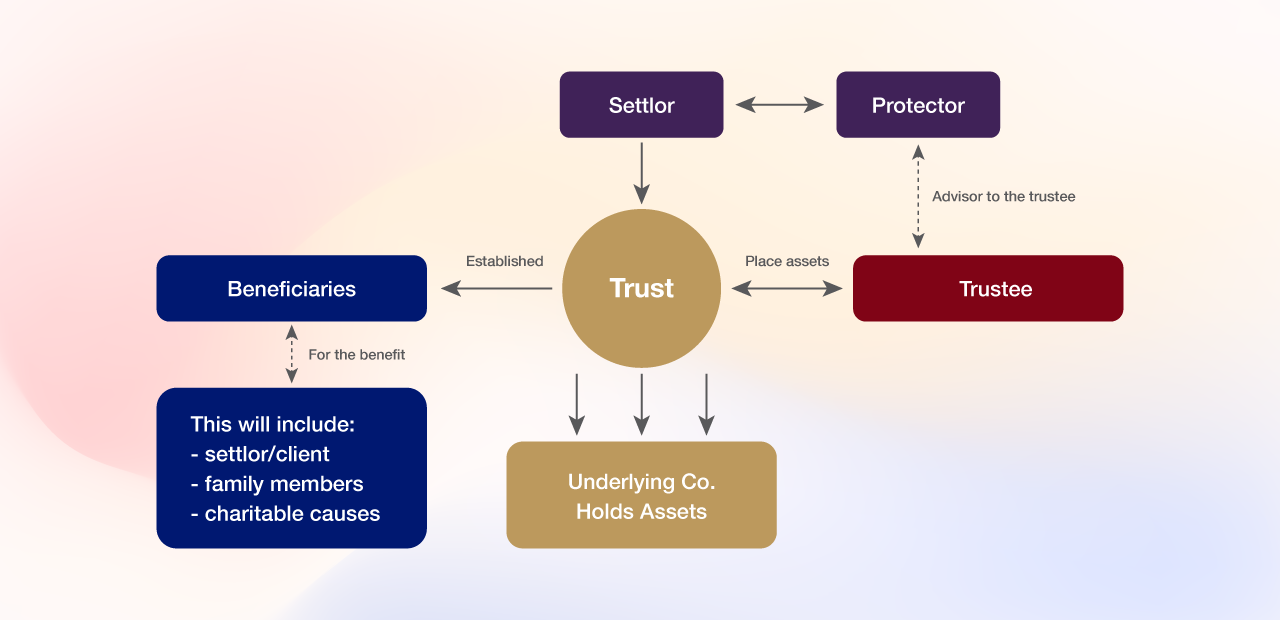

A Labuan Trust is governed by the Labuan Trust Act 1996 (The Trust Act) which was updated in 2010. The legal concept involves regulating the relationships between the settlor, trustee and beneficiary.

Assets in the trust are held in the trustee’s name (as a legal owner) and are dealt in accordance with the trust deed. The trustee has a fiduciary duty to ensure the trust assets are managed prudently and in the best interest of the beneficiaries (equitable owner).

A highly effective vehicle for asset/ wealth preservation, protection and succession planning to pass on wealth from one generation to the next, trust structures are traditionally used in common law countries and can protect the trust’s assets against creditor claims, insolvency, divorce, and inheritance claims. There is also flexibility to set up as a Shariah-compliant trust for Islamic wealth management and estate planning purposes.

Labuan Trust Structures

A Labuan Trust is governed by the Labuan Trust Act 1996 (The Trust Act) which was updated in 2010. The legal concept involves regulating the relationships between the settlor, trustee and beneficiary.

Assets in the trust are held in the trustee’s name (as a legal owner) and are dealt in accordance with the trust deed. The trustee has a fiduciary duty to ensure the trust assets are managed prudently and in the best interest of the beneficiaries (equitable owner).

A highly effective vehicle for asset/ wealth preservation, protection and succession planning to pass on wealth from one generation to the next, trust structures are traditionally used in common law countries and can protect the trust’s assets against creditor claims, insolvency, divorce, and inheritance claims. There is also flexibility to set up as a Shariah-compliant trust for Islamic wealth management and estate planning purposes.

Labuan Trust Structures

A Labuan Special Trust (LST) is an innovative feature of the Labuan Trusts Act 1996 (LTA) and can be used to hold shares in a Labuan holding company, which in turn may own assets. The benefit of an LST is that there is a distinct separation between the custodian role of the trustees and the management of the company which is the responsibility of only the directors. The LST can be used for succession planning, commercial purposes and matrimonial settlement.

Labuan IBFC Foundations: “TRULY ONE OF A KIND IN ASIA”

Why set up a Labuan foundation?

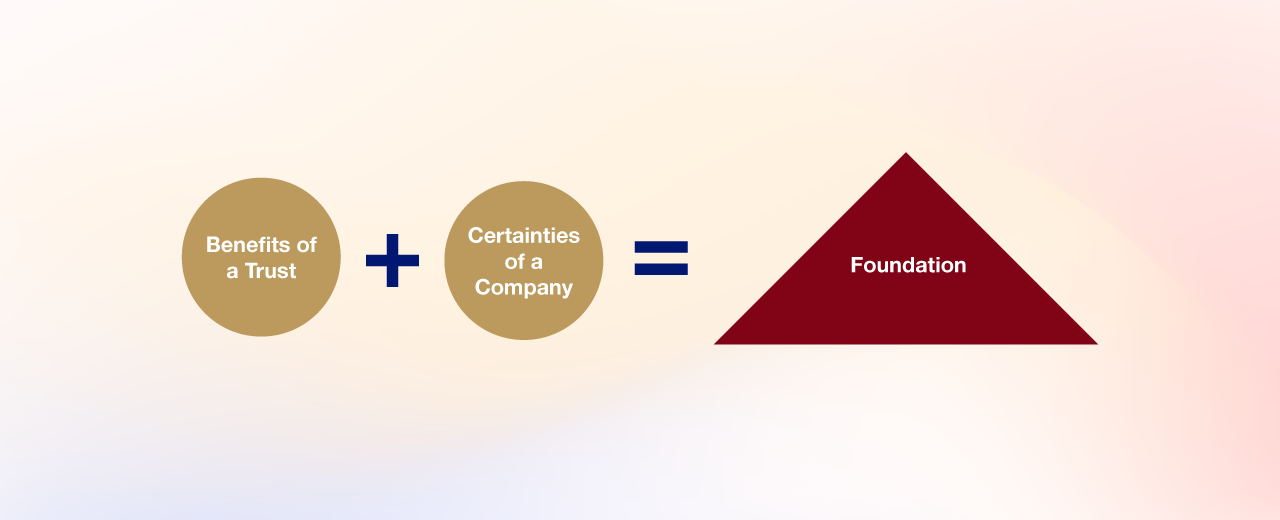

A foundation is a legal entity administered by a charter and articles, enjoying aspects of corporate personality, into which assets can be placed. The foundation owns the title to such assets, can enter into contracts, acquire properties, own a bank account or even own a share in its own name. Having a foundation gives both the benefits of a trust and the certainty of a company.

Labuan Conventional and Islamic Foundations

A conventional foundation is a way forward for facilitating succession planning and asset protection. As referred to in the Labuan Foundations Act, 2010, a Labuan foundation is a corporate body with an independent legal entity established to govern its own assets for any legitimate purpose, whether charitable or non-charitable.

Labuan Islamic foundations can be established under Section 107 of the Labuan Islamic Financial and Securities (Amendment) Act 2022, and all provisions under the Labuan Foundations Act 2010 shall be applied accordingly. The purpose or the objective of setting up an Islamic foundation must comply with Shariah principles. Thus, an Islamic foundation is required to appoint a Shariah Adviser to advise on Islamic matters to be in accordance with Shariah principles. Additionally, the related endowment may be facilitated by way of Hibah or Hadiah.

Labuan International Waqf Foundation (LIWF): The First Islamic Foundation in the Asian International Market

Waqf is a key aspect of Islamic wealth management where it is used to generate revenue for charitable purposes such as education and welfare. A unique aspect of the LIWF is its flexibility to be utilised as an Islamic wealth management vehicle and at the same time, for charitable purposes.

A conventional foundation is a way forward for facilitating succession planning and asset protection. As referred to in the Labuan Foundations Act, 2010, a Labuan foundation is a corporate body with an independent legal entity established to govern its own assets for any legitimate purpose, whether charitable or non-charitable.

Labuan Islamic foundations can be established under Section 107 of the Labuan Islamic Financial and Securities (Amendment) Act 2022, and all provisions under the Labuan Foundations Act 2010 shall be applied accordingly. The purpose or the objective of setting up an Islamic foundation must comply with Shariah principles. Thus, an Islamic foundation is required to appoint a Shariah Adviser to advise on Islamic matters to be in accordance with Shariah principles. Additionally, the related endowment may be facilitated by way of Hibah or Hadiah.

Labuan International Waqf Foundation (LIWF): The First Islamic Foundation in the Asian International Market

Waqf is a key aspect of Islamic wealth management where it is used to generate revenue for charitable purposes such as education and welfare. A unique aspect of the LIWF is its flexibility to be utilised as an Islamic wealth management vehicle and at the same time, for charitable purposes.

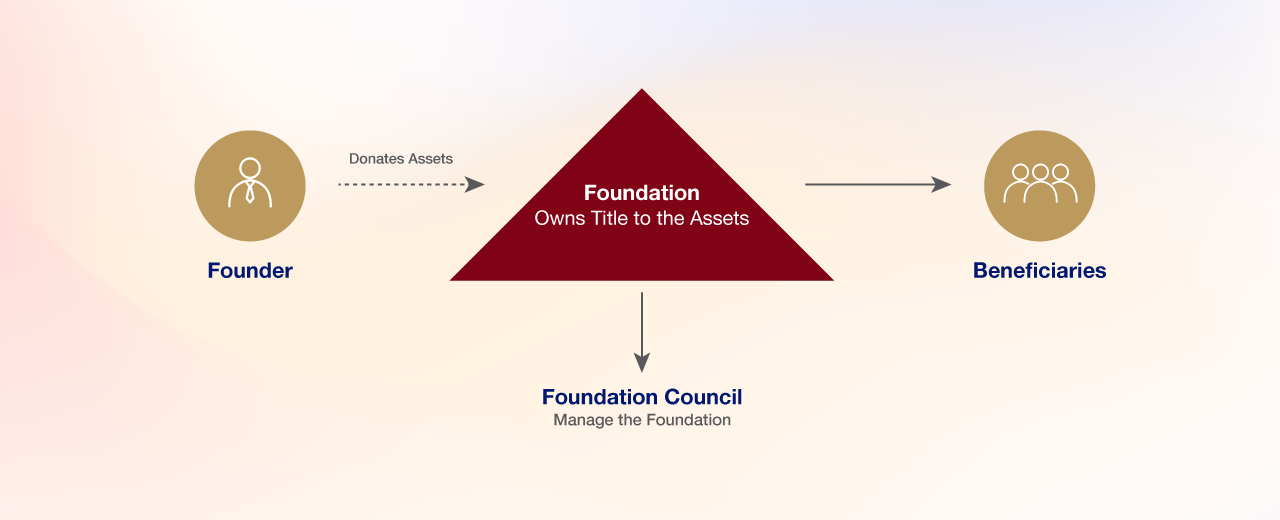

Structure of a Labuan Foundation/LIWF

A founder may form a Labuan foundation by filing the foundation's charter, specifying the initial assets endowed for the foundation's establishment, and meeting all other applicable regulatory requirements by Labuan Financial Services Authority (Labuan FSA). Such assets are managed in the interest of beneficiaries who could benefit from it despite the fact that foundation holds ownership to it. The founder may also appoint council member(s) and officer(s) for the foundation.

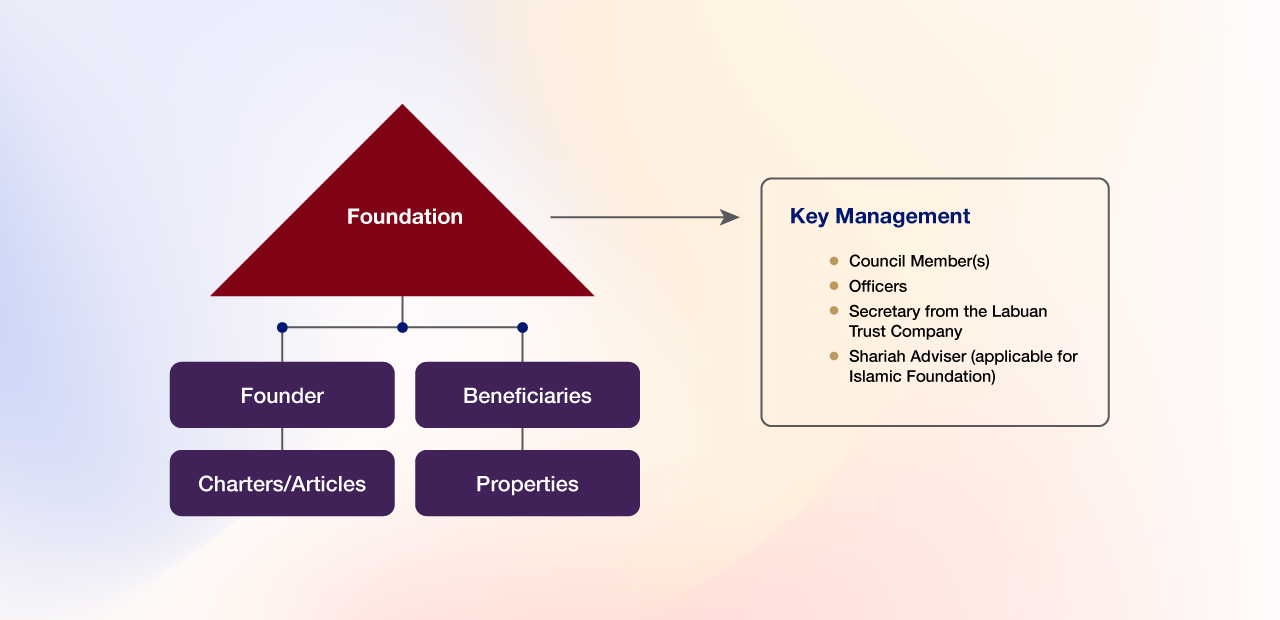

The above is a common structure of a Labuan foundation. Key members of management for a normal Labuan foundation comprise a council member, officer and secretary. For a LIWF, an additional member is a Shariah adviser.

What do these structures provide?

Which structure suits best?

Depends on:

For more details, please contact [email protected].

The above is a common structure of a Labuan foundation. Key members of management for a normal Labuan foundation comprise a council member, officer and secretary. For a LIWF, an additional member is a Shariah adviser.

What do these structures provide?

- Wealth preservation: Helps to preserve wealth in a tax efficient manner

- Confidentiality/Anonymity: Ownership is held under the name of the trustee foundation

- Flexibility: Changes/updates/amendments can be made with minimal interruption

- Protection: Provides protection against creditor, foreign, insolvency and marriage claims

- Consolidation: Allows parties to structuralise their total asset worth and place it into a consolidated asset holding (minimising complication/parties)

- Certainty: Allows decisions to be made based on one holistic structure

- Legal certainty: Established based on legal guidelines issued by Labuan FSA and endorsed by its Shariah Supervisory Council

Which structure suits best?

Depends on:

- Each client’s specific needs and ambition, complexity of their wealth/digital assets

- Long-term plans – business/personal

- Short-term objectives – what to achieve now (planning/protection vs investment/diversification)

- Their needs now vs family/children’s needs in the future

- No one-size-fits-all solutions

For more details, please contact [email protected].

Mari-Len NGU is the Managing Director and Head of Group Client Coverage at Pacific Trustees Group in Labuan, Hong Kong, Singapore and Malaysia. She has more than 20 years of experience in the trust and fiduciary industry as well as corporate governance. She led the private clients team in Hong Kong, Singapore and Jersey Channel Islands, from one of the biggest International trust company where she develops international workflows and processes within these jurisdictions’ applicable laws.

Mari-Len is licensed as a secretary by the Companies Commission in Malaysia, is a full member of the Society of Trust and Estate Practitioner (STEP) in the UK and is an approved trust officer under the Labuan Financial Services and Securities Act, 2010.

Mari-Len is licensed as a secretary by the Companies Commission in Malaysia, is a full member of the Society of Trust and Estate Practitioner (STEP) in the UK and is an approved trust officer under the Labuan Financial Services and Securities Act, 2010.