1. Introduction – The Shifting Landscape

Across the world, families have sought structures that can safeguard their wealth, preserve values, and sustain enterprises across generations. What was once an informal arrangement between trustees and advisers has, over time, matured into what can be described as family enterprise governance: a structured approach to managing assets, planning succession, and embedding long-term strategy.

These governance platforms serve much like a trust, protecting assets while also enabling strategic planning, professional management, and cross-generational decision-making. As globalisation accelerates and generational priorities evolve, service providers have reshaped their offerings into two dominant approaches: institutionalisation and marketisation.

- Institutionalisation, is led by established players e.g. commercial banks, investment banks, trust companies, insurers, securities firms, and law firms — leveraging existing client relationships, brand credibility, and structured service systems.

- Independent and market-driven models, often boutique in nature, offering more personalised solutions tailored to the unique needs of each family.

This is where the role of family enterprise is shifting from a traditional gatekeeper mainly focused on preserving wealth to a strategist capable of guiding families through complex decisions on governance, succession, investment, and legacy. Below are some common scenarios.

Consider a technology founder whose company has just gone public, or a Malaysian palm oil family that has diversified into renewable energy. Both face similar challenges: complex asset portfolios spread across multiple jurisdictions, children educated overseas with different citizenships, and businesses at an inflection point where strategic reinvestment or partial exits are on the table. For these families, the question is no longer just “How do we protect what we have?” but “How do we grow, adapt, and sustain our influence in a changing world?”.

B. Changing Client Expectations

Back then the primary focus was simply managing investment portfolios and household expenses. Today’s next-generation family members expect:

- Integrated governance that clearly defines roles, responsibilities, and decision-making powers among family members.

- Professional oversight over investments, from venture capital and private equity to sustainable projects.

- Cross-border solutions that can address multi-jurisdictional tax, residency, and inheritance issues.

C. Cross-Border Wealth Mobility

The new generation of wealthy Asian families is highly mobile. Children study in the UK or US, parents split time between multiple homes, and investments are increasingly global. This mobility means that multi-jurisdictional planning tools are essential. Recent years have also highlighted the importance of regulatory stability and neutrality. Political shifts in some traditional financial centres have led families to seek jurisdictions that balance robust compliance with flexibility.

D. Competitive Differentiation for Wealth Hubs

For wealth hubs across Asia, the evolution of governance models for families is a competitive opportunity. Those that can position themselves as strategic partners, not merely custodians, will capture the attention of Asia’s most sophisticated families. This means going beyond offering tax advantages or corporate services. It’s about building ecosystems where legal, financial, governance, and lifestyle needs are met under one roof.

3. The Strategic Pivot - From Asset Protection to Value Creation

This is where the right financial tools and governance structures make all the difference. By combining asset protection with strategic oversight, families can address the very challenges of concentration, mobility, and generational change that define Asia’s wealth landscape.

A truly modern family enterprise governance must provide strategic architecture — solutions that both protect and actively grow wealth.

- Insurance – Using customised insurance solutions to manage risk, safeguard assets, and provide liquidity for estate taxes or buy-sell agreements.

- Wealth Management – Coordinating global investment portfolios across asset classes and geographies, ensuring alignment with the family’s risk profile and long-term objectives.

- Estate Planning – Structuring the orderly transfer of wealth through trusts, private foundations, and wills to minimise disputes, tax liabilities, and administrative delays.

- Asset Management and Protection – Consolidating holdings under holding companies or foundations for centralised oversight, enhanced asset protection, and streamlined decision-making.

- Family Governance – Embedding constitutions, governance charters, and decision-making protocols within a family constitution to clearly define roles, responsibilities, and dispute resolution mechanisms.

- Succession Planning – Preparing the next generation for leadership through phased ownership transfers, training, and formal succession frameworks integrated into the family’s structures.

- Philanthropy – Institutionalising charitable giving through dedicated councils or sub-funds within a foundation, ensuring social impact aligns with the family’s values and legacy goals.

When combined, these pillars transform what was once a static custodian into a strategic command centre, capable of protecting the past, navigating the present, and shaping the family’s future for generations to come.

Similar to a trust, it can hold and protect assets for the benefit of designated beneficiaries, ensuring privacy, asset protection, and long-term succession planning. Like a company, it is a legal entity in its own right, capable of owning property, entering contracts, and being managed by appointed officers and councils.

What makes it even more compelling is that, across Southeast Asia, the private foundation model is only available in Labuan IBFC. This exclusivity gives families access to a governance tool that is internationally supported by a regulated jurisdiction enforced by a centralised regulator, Labuan Financial Services Authority.

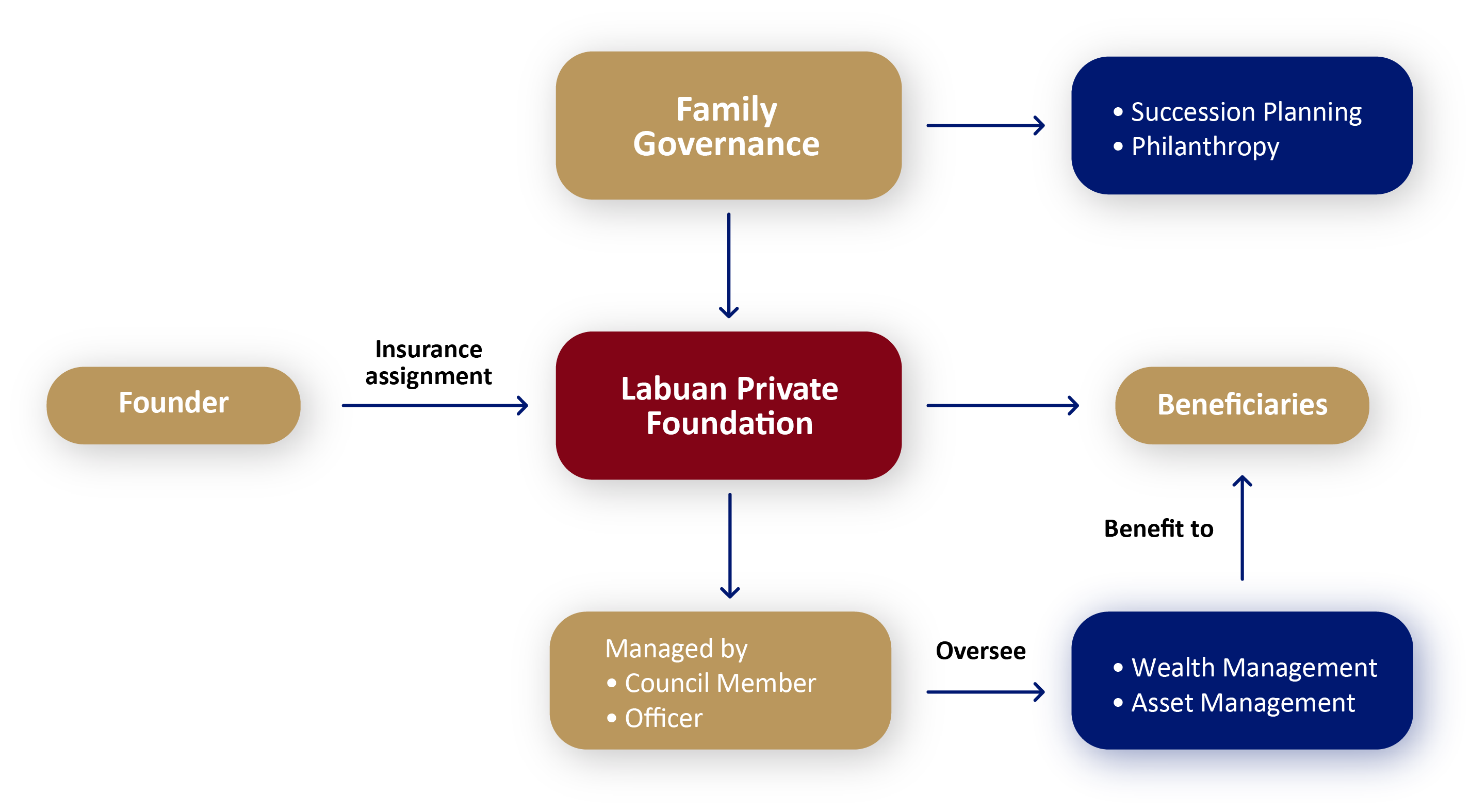

Labuan Foundations – Governance and Legacy in One Structure

i. Founder

- Insurance assignment – The founder can assign life insurance or key-person insurance policies to the foundation, ensuring that proceeds are received and managed in line with the family’s governance and succession plan.

- The founder transfers selected assets or rights into the foundation to ring-fence them from personal liabilities and provide long-term protection.

ii. Family Governance

- The family governance framework (e.g., family constitution, council rules) guides how the foundation operates, sets strategic priorities, and ensures alignment between generations.

- Governance scope includes succession planning and philanthropy

iii. Beneficiaries

- The foundation is set up to benefit designated beneficiaries such as family members, charities, or other entities chosen by the founder.

- Distributions to beneficiaries follow the foundation’s charter and governance rules, ensuring fairness, transparency, and alignment with the founder’s long-term vision.

iv. Managed by Council Members & Officers

- The Council members act like directors in a company, setting policies, approving investments, and overseeing the foundation’s compliance and governance.

- Officers handle day-to-day operations, execution of investment decisions, and communication with service providers.

v. Wealth & Asset Management

- The foundation oversees wealth and asset management activities to ensure they meet both return objectives and risk parameters defined in the governance framework.

- This may include diversifying investments, managing real estate holdings, or funding private equity ventures.

vi. Strategic Outcomes

- By integrating insurance, governance, asset protection, investment oversight, and succession planning into one structure, the Labuan Private Foundation becomes the strategic tool of the family enterprise, ensuring assets are not only preserved but also actively grown and aligned with the family’s values.

- A Reputable International Business and Financial Centre

- Tax Efficiency in a Regulated Environment

- Strategic Access to Global Markets

- Comprehensive Suite of Financial and Wealth Structures

- Labuan Trusts for asset protection and bespoke estate planning.

- Holding Companies for consolidating global investments.

- Private Funds for collective investment strategies.

- Captive Insurance for bespoke risk management.

- International Recognition and Compliance Credibility

In this transformation, Labuan Foundations stand out as a structural backbone. They merge the strengths of asset protection with the sophistication of strategic governance, enabling families to embed long-term vision, clear decision-making, and transparent oversight into their wealth structures.

Ultimately, the defining factor for success will not be the size of the portfolio or the complexity of the structure, but how effectively the governance framework adapts. Those that embrace the strategist’s role, leveraging tools like Labuan trusts, foundations, and holding companies, will move beyond guarding the past to actively shaping a legacy that thrives for generations to come.

_Ricky/BBS-(Transparent)-Finalized-Logo-PNG.png)