Captive Insurance

Labuan IBFC: Enabling Business Resilience through Captive Insurance

Share this page

As global risks grow more complex—from cyber threats to climate change—companies are turning to captive insurance to take control of their risk strategies. In Asia, Labuan International Business and Financial Centre (Labuan IBFC) stands out as the region’s most dynamic and trusted domicile for captives.

Captive Insurance Explained

Captive insurance is a form of self-insurance where a company sets up its own insurance subsidiary to cover risks that may be uninsurable or too expensive in the commercial market. This gives the parent company greater control over underwriting, claims management, and coverage customisation.

In Labuan IBFC, captive insurance is regulated under the Labuan Financial Services and Securities Act 2010 (LFSSA) for conventional captives, and under the Labuan Islamic Financial Services and Securities Act 2010 (LIFSSA) for takaful captives. These legal frameworks ensure that captives are structured, operated, and supervised in line with international standards.

In Labuan IBFC, captive insurance is regulated under the Labuan Financial Services and Securities Act 2010 (LFSSA) for conventional captives, and under the Labuan Islamic Financial Services and Securities Act 2010 (LIFSSA) for takaful captives. These legal frameworks ensure that captives are structured, operated, and supervised in line with international standards.

Labuan IBFC: A Captive Insurance Hub

- Host to 800+ licensed financial institutions, including 220+ insurance and risk management license holders.

- Offers a full-spectrum ecosystem that offers end-to-end support for captives, making Labuan IBFC the go-to hub for comprehensive, trusted, and globally connected risk solutions.

- Operates within a robust legal framework aligned with International Association of Insurance Supervisors (IAIS) principles and global best practices.

- Demonstrates proportionality in regulatory approach by swiftly adapting to market shifts, especially during hard insurance cycles:

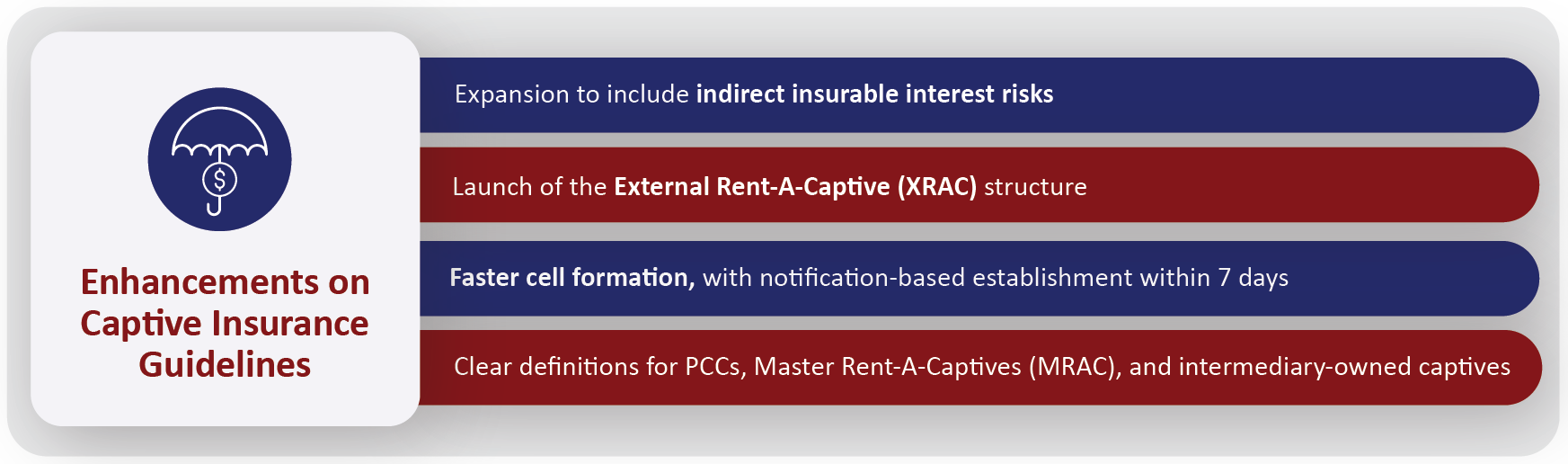

Key updates to Labuan’s Captive Insurance Guidelines, effective 2024

A Wide Range of Captive Solutions

Labuan IBFC offers one of the most diverse and forward-thinking captive insurance ecosystems in the region—covering conventional, digital, and Shariah-compliant solutions to suit every type of business.

Whether you're a multinational, a regional conglomerate, or a fast-growing digital player, Labuan IBFC has the right structure for your risk management needs:

Whether you're a multinational, a regional conglomerate, or a fast-growing digital player, Labuan IBFC has the right structure for your risk management needs:

Pure/Single-Owner Captives

Group, Mutual & Association Captives

Master & Subsidiary Rent-A-Captives

- Owned by one company

- Offers full control over insurance decisions and tailored coverage

- Ideal for companies insuring their own risks

- Aims for maximum cost efficiency

Group, Mutual & Association Captives

- Jointly owned by multiple companies or members

- Designed for industry groups or trade associations

- Helps members manage collective risks more efficiently

- Encourages collaboration and cost-sharing among participants

Master & Subsidiary Rent-A-Captives

- Serves as a cost-effective entry point into captive insurance

- Ideal for smaller or emerging businesses

- Offers flexibility without the full commitment of owning a captive

- Allows less than 50% shareholding by MRAC under the XRAC structure

Protected Cell Companies (PCCs):

- Single legal entity with multiple ring-fenced cells

- Each cell is legally separated, protecting assets and liabilities

- Ideal for managing diverse risks under one structure

- A cost-effective and scalable risk management solution

In short, Labuan IBFC’s flexible captive frameworks are built to fit businesses of all sizes and risk appetites—giving you the tools to take control of your insurance strategy and unlock long-term value.

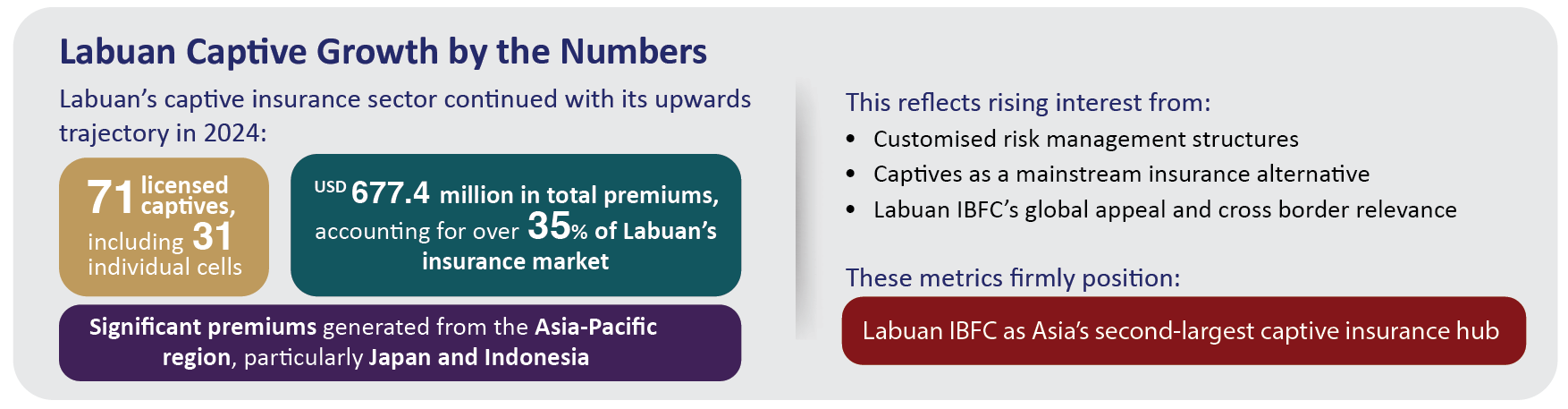

Strong 2024 growth cements Labuan IBFC as Asia’s second-largest captive insurance hub

Source: Labuan IBFC Market Report 2024

International Recognition

Labuan IBFC’s excellence has earned it a place on the global captive stage:

As the only Asian jurisdiction regularly shortlisted alongside global leaders, Labuan IBFC continues to strengthen its international reputation.

- Highly Commended International Domicile, European Captive Review Awards (2022 & 2023)

- Top International Captive Domicile, European Captive Review Awards (2021)

- Best Asian Domicile, Asia Captive Review Awards (2021)

As the only Asian jurisdiction regularly shortlisted alongside global leaders, Labuan IBFC continues to strengthen its international reputation.

Future-Ready Captives with Labuan IBFC

As risks grow more complex, Labuan captives are evolving to meet the moment. From cyber threats and climate disasters to trade disruptions and ESG-linked risks, businesses are turning to Labuan IBFC for smart, flexible coverage that addresses today’s most pressing challenges.

With a progressive regulatory framework and customisable structures, Labuan IBFC offers a future-ready ecosystem for strategic risk management. It’s where innovation meets stability—backed by expertise and regional connectivity.

In a fast-changing world, Labuan IBFC isn’t just keeping up—it’s leading the way. For businesses ready to take control of their risks, Labuan IBFC is the smart choice.

Labuan IBFC: Trusted Expertise for Global Investors

Labuan IBFC is Malaysia’s only international business and financial centre, offering a suite of financial services including:

These offerings come in conventional, Shariah-compliant, and digital formats, — empowering investors to tailor structures that align perfectly with their values and business goals.

Regulated by the Labuan Financial Services Authority (Labuan FSA), Labuan IBFC adheres to international standards and best practices from key global bodies such as the OECD, APG, and FATF — ensuring strong compliance, transparency, and investor confidence.

- Banking and insurance, including re-insurance

- Capital market-related activities

- Islamic finance

- Wealth management

- Leasing and commodity trading

These offerings come in conventional, Shariah-compliant, and digital formats, — empowering investors to tailor structures that align perfectly with their values and business goals.

Regulated by the Labuan Financial Services Authority (Labuan FSA), Labuan IBFC adheres to international standards and best practices from key global bodies such as the OECD, APG, and FATF — ensuring strong compliance, transparency, and investor confidence.

Key advantages enjoyed by Labuan IBFC entities:

- Access to Malaysia’s double tax treaties (70+ countries)

- Currency flexibility with liberal exchange controls

- Fiscal neutrality and no estate/inheritance tax

Have Questions About Labuan Captive Insurance?

To kickstart your wealth structuring, email us at

for further information or to book a confidential consultation.

Have Questions About Labuan Wealth Management?

To kickstart your wealth structuring, email us at

for further information or to book a confidential consultation.