Wealth Management

Labuan IBFC: Asia’s Safe Harbour for Generations of Wealth

Share this page

As global wealth management needs evolve, investors and families are seeking jurisdictions that offer flexibility, protection, and global connectivity.

Positioned strategically in Asia, Labuan International Business and Financial Centre (Labuan IBFC) is a fast-growing regional hub for cross-border wealth and estate planning — with the matching infrastructure, regulation, and tax advantages.

Total Wealth Control, One Ecosystem

Labuan IBFC provides a seamless environment tailored for high-net-worth individuals (HNWIs) and families seeking smart wealth management solutions. Key benefits include:

Labuan IBFC’s ecosystem ensures the wealth management services offered are streamlined, compliant, and cost-effective helping you protect and grow your assets with confidence.

- Tax-efficient structures designed for businesses engaged in non-trading investment holding

- Access to a vast network of expert advisors, including lawyers, tax specialists, and estate planners

- Over 200 licensed insurance providers and 60+ global banks supporting wealth preservation and liquidity needs

Labuan IBFC’s ecosystem ensures the wealth management services offered are streamlined, compliant, and cost-effective helping you protect and grow your assets with confidence.

Structure Smarter: Tailored Wealth Solutions in Labuan IBFC

Labuan IBFC offers a range of specialised structures for managing, preserving, and passing on wealth.

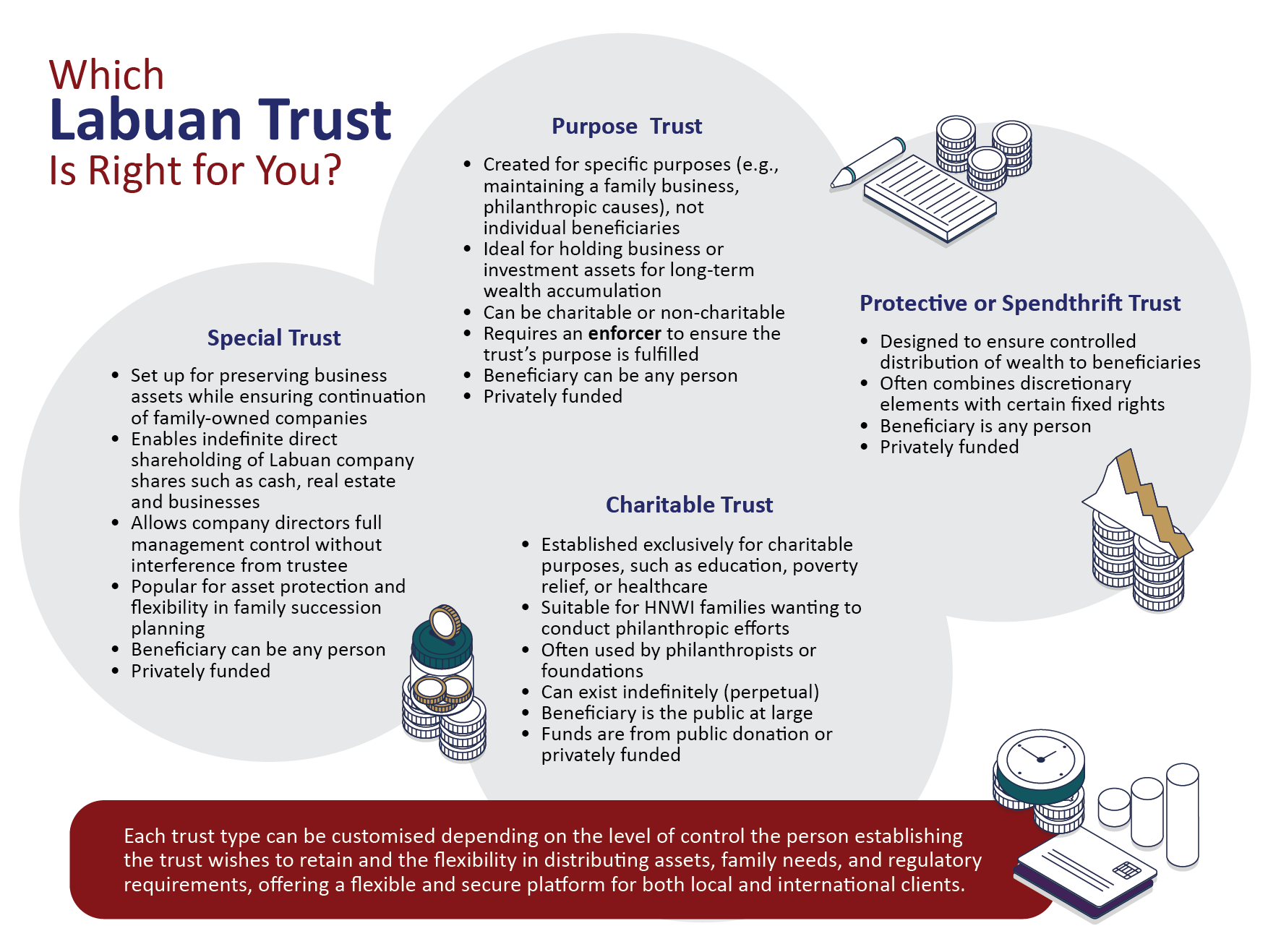

Labuan Trusts

Labuan Trusts

- Established under the Labuan Trusts Act 1996

- Allow a person establishing the trust to transfer assets to a trustee, who manages the assets for the benefit of designated beneficiaries

- Offer strong asset protection and are commonly used for estate planning/income distribution, wealth preservation, and charitable purposes

- Labuan Trusts benefit from a favourable tax regime with no capital gains, inheritance, or withholding taxes

Choose the right Labuan Trust to secure, protect, and grow your wealth with confidence

Labuan Private Trust Companies (PTCs)

- Established under the Labuan Financial Services and Securities Act 2010

- Established to act as trustee for a group of connected persons (family or group of related trusts), offering greater control and confidentiality in wealth management

- Commonly used by HNWIs to administer family assets while maintaining influence over trust decisions through appointed directors

- PTCs benefit from a favourable regulatory environment and tax efficiency

Labuan Foundations

- Established as a legal entity under the Labuan Foundations Act 2010

- Primarily used for wealth management, asset protection, and succession planning

- Combine features of both trusts and companies, offering a flexible structure with legal ownership held by the foundation, not by individuals

- Particularly attractive to HNWIs due to their tax efficiency and ability to serve both charitable and non-charitable (private) purposes

- Labuan IBFC was the first jurisdiction to facilitate the establishment of international Waqf foundations

Labuan Protected Cell Companies (PCCs)

- Established as a single corporate structure under the Labuan Companies Act 1990

- PCCs allow HNWIs or families to divide assets/investments into separate cells for different objectives while preserving the independence of each cell

- This structure enhances asset protection by legally ensuring each cell is ring-fenced protected from the debts and liabilities of other cells

- A strategic vehicle for estate planning, multi-generational wealth preservation, and global investment diversification due to the structure’s flexibility

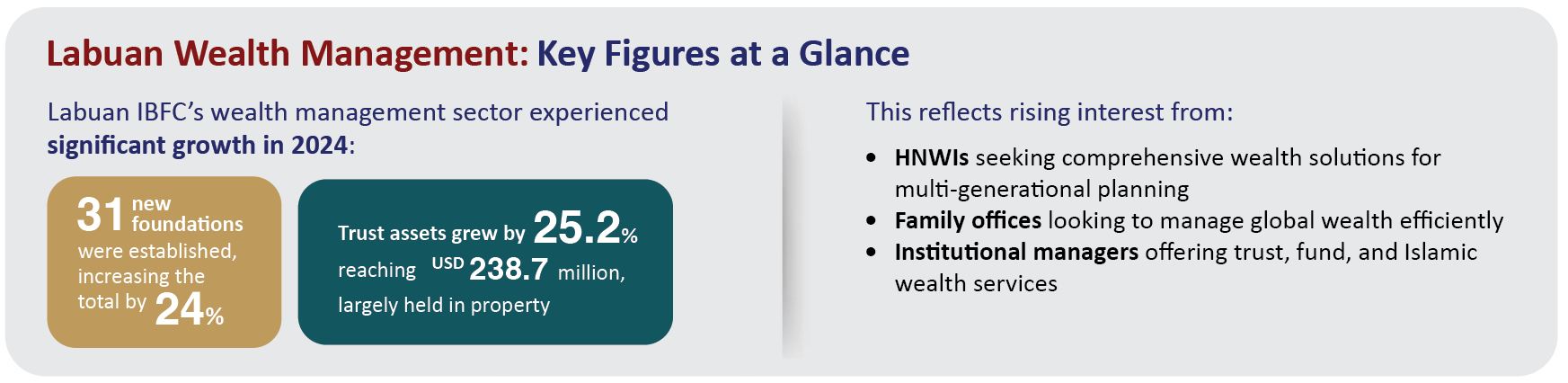

Growing trust assets and new foundations highlight Labuan IBFC’s appeal for global wealth management

Source: Labuan IBFC Market Report 2024

Labuan IBFC: The Future-Proof Choice for Dynamic Wealth Planning

For families, businesses, and wealth managers aiming for long-term growth and flexibility, Labuan IBFC offers a trusted gateway in the region.

Backed by a strong legal framework, diverse financial services, and adherence to global standards, Labuan IBFC is perfectly equipped to meet the evolving demands of today’s global wealth landscape.

Backed by a strong legal framework, diverse financial services, and adherence to global standards, Labuan IBFC is perfectly equipped to meet the evolving demands of today’s global wealth landscape.

Labuan IBFC: Trusted Expertise for Global Investors

Labuan IBFC is Malaysia’s only international business and financial centre, offering a suite of financial services including:

These offerings come in conventional, Shariah-compliant, and digital formats, —empowering investors to tailor structures that align perfectly with their values and business goals.

Regulated by the Labuan Financial Services Authority (Labuan FSA), Labuan IBFC adheres to international standards and best practices from key global bodies such as the OECD, APG, and FATF — ensuring strong compliance, transparency, and investor confidence.

- Banking and insurance, including re-insurance

- Capital market-related activities

- Islamic finance

- Wealth management

- Leasing and commodity trading

These offerings come in conventional, Shariah-compliant, and digital formats, —empowering investors to tailor structures that align perfectly with their values and business goals.

Regulated by the Labuan Financial Services Authority (Labuan FSA), Labuan IBFC adheres to international standards and best practices from key global bodies such as the OECD, APG, and FATF — ensuring strong compliance, transparency, and investor confidence.

Key advantages enjoyed by Labuan IBFC entities:

- Access to Malaysia’s double tax treaties (70+ countries)

- Currency flexibility with liberal exchange controls

- Fiscal neutrality and no estate/inheritance tax

Have Questions About Labuan Wealth Management?

To kickstart your wealth structuring, email us at

for further information or to book a confidential consultation.

Have Questions About Labuan Wealth Management?

To kickstart your wealth structuring, email us at

for further information or to book a confidential consultation.