Labuan IBFC together with Kensington Trust Labuan Limited will host a masterclass entitled “Wealth Management in

Labuan IBFC: Private Funds & Foundations" on 4 November 2025 in Kuala Lumpur.

With cross-border wealth and investment needs becoming increasingly sophisticated, choosing the right jurisdiction and structures is critical for long-term success. As Asia’s trusted hub for wealth management and cross-border structuring, Labuan IBFC offers flexible, future-ready solutions that support both institutional and family wealth strategies.

This exclusive masterclass will present the latest regulatory updates from the Labuan Financial Services Authority and insights from Labuan IBFC, followed by expert discussions with leading lawyers, wealth managers, and Kensington Trust Labuan Limited. Topics include strengthening investor confidence, structuring private funds, in different forms of investment vehicles, discussing practical issues on setting up and complying with annual requirements on maintaining private funds structures, and leveraging Labuan foundations for effective wealth management and succession planning.

Join us as we explore the latest insights, strategies, and innovations designed to help investors, families, and businesses preserve and grow wealth through Labuan IBFC’s unique value propositions.

Speakers

-

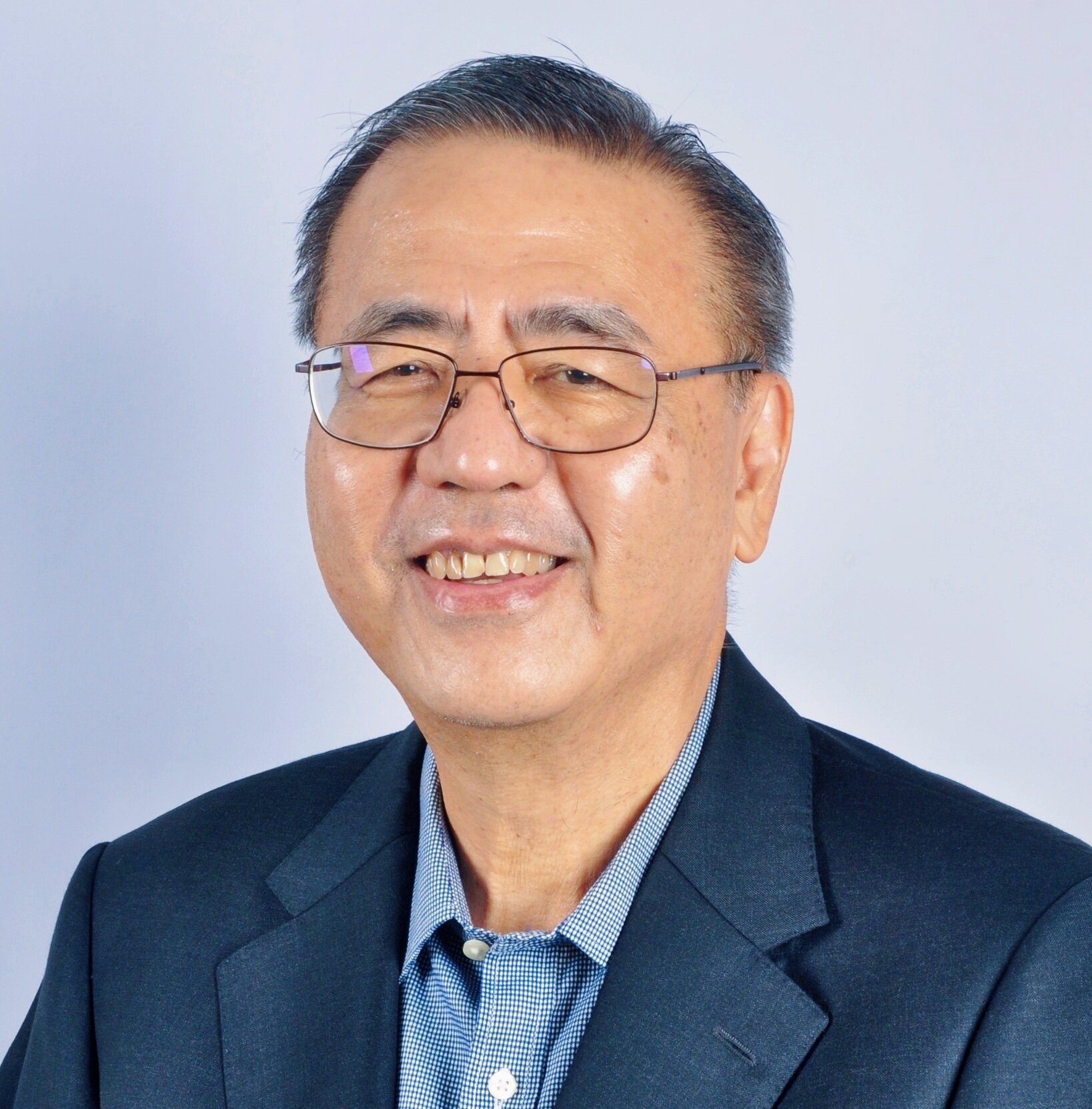

Dato’ Raymond W.B. Wong, Founder Member and Regional Managing Director, Kensington Trust Group

Dato’ Raymond W.B. Wong, Founder Member and Regional Managing Director, Kensington Trust Group

FCPA, CA (M), FCTIM, CFP, TEP

With over three decades of distinguished experience in the trust and fiduciary industry, Dato’ Raymond W.B. Wong is a prominent figure in the Asia Pacific financial services sector. As a Founder Member and the Regional Managing Director of Kensington Trust Group, Dato’ Raymond has played a pivotal role in shaping the group’s regional presence and influence.

A graduate in Economics and Accounting from Macquarie University, Australia, Dato’ Raymond holds numerous professional credentials, including Fellow membership with CPA Australia, Chartered Accountant status with the Malaysian Institute of Accountants, and certification as a Certified Financial Planner. He is also a Fellow Member of the Chartered Taxation Institute of Malaysia and a Full Member of the Society of Trust and Estate Practitioners (TEP).

Dato’ Raymond has been a driving force in industry development, notably founding STEP Malaysia in 2012 and serving as its Chairman until 2016. He is an approved Trust Officer for Labuan and has held leadership roles in the Association of Labuan Trust Companies (ALTC), including Chairman and most recently Deputy Chairman (2021–2024). His expertise is frequently sought after in various committees, such as the Labuan International Financial Exchange Committee.

His commitment to professional excellence extends into academia, where he served as a CPA Australia exam supervisor in Labuan on behalf of Deakin University. He has also actively contributed to professional bodies, including the Malaysian Institute of Accountants, where he was Vice Chairman for the Labuan Chapter under the Sabah Branch until 2002.

Beyond his professional accomplishments, Dato’ Raymond has shown unwavering dedication to community leadership, serving as Chairman of the Kwong Wei Siew Association in Labuan (2013–2022) and being conferred Honorary Life President in 2024.

In recognition of his contributions to society, he was awarded the Darjah Indera Mahkota Pahang (D.I.M.P) in 2014 by the Sultan of Pahang, bestowing upon him the honorary title of Dato'. -

Farah Jaafar, Independent Non-Executive Director (INED), Webull Securities Malaysia and Tyndall Insurance Labuan, Advisor, Fintech Association Malaysia

Farah Jaafar, Independent Non-Executive Director (INED), Webull Securities Malaysia and Tyndall Insurance Labuan, Advisor, Fintech Association Malaysia

Farah Jaafar is a seasoned senior executive, board advisor, and governance leader with nearly 30 years of experience spanning capital markets, offshore finance, fintech, and digital assets. She has shaped financial policy frameworks while advancing innovation and digital transformation across financial ecosystems.With a professional foundation in law and corporate governance, she is adept at translating complex financial and regulatory concepts into strategic vision and actionable insights—helping organisations align around strategy, risk, and long-term value creation.

A passionate advocate for technology adoption, financial inclusion, and diversity, Farah is guided by the belief that “a rising tide lifts all boats.” She serves as a trusted advisor to boards navigating transformation, bringing expertise in governance, strategy, stakeholder engagement, and sustainable growth. -

Jeck Ting, Business Development Director, Visionary Capital Limited

Jeck Ting, Business Development Director, Visionary Capital Limited

Jeck is a highly accomplished professional with a strong academic foundation and extensive experience across multiple areas of the finance industry. He holds a law degree and has further enhanced his expertise through postgraduate studies in corporate governance and accounting, reflecting his dedication to continuous learning. His career spans advisory roles at Deloitte, internal audit, and the life insurance sector, where he has demonstrated proven abilities in risk management, compliance, and financial analysis. Jeck also holds a Diploma in Real Estate Management and is a Registered Financial Planner in Malaysia, underscoring his expertise in financial planning and investment strategies.

At Visionary Capital, Jeck oversees operations and business development, leveraging his deep understanding of trading and investment to drive the company’s success. His ability to identify and resolve operational challenges ensures Visionary Capital operates seamlessly.

Jeck’s leadership is defined by integrity, innovation, and a client-first approach. He fosters a collaborative culture and empowers his team to achieve Visionary Capital’s mission of delivering outperformance for clients. His expertise in legal, financial, and operational matters ensures Visionary Capital remains a trusted partner to its investors. -

June Chin, Associate Director, Kensington Trust Labuan Limited

June Chin, Associate Director, Kensington Trust Labuan Limited

June graduated with a degree in Marketing from the University of Hertfordshire and subsequently obtained her Chartered Governance Professional qualification from The Chartered Governance Institute, UK (ICSA). She is also an Associate Member of the Malaysian Institute of Chartered Secretaries and Administrators (MAICSA). In addition, she is a licensed Trust Officer approved by Labuan Financial Services Authority, reflecting her expertise in the trust and fiduciary services sector.

Her career in LabuanIBFC began in 2010, where she has since gained extensive hands-on experience in the trust and corporate services industry.

She is the Associate Director of Kensington Trust Labuan Limited. In this capacity, she plays a key role in advising clients on the establishment and administration of Labuan private funds, trusts, and investment vehicles, while ensuring regulatory compliance and meeting the evolving needs of global investors. -

Yeat Soo Ching, Partner, Cheang & Ariff Advocates & Solicitors

Yeat Soo Ching, Partner, Cheang & Ariff Advocates & Solicitors

Soo Ching is a graduate of Sheffield University, United Kingdom and she was called to the Malaysian Bar in 2000. She also holds a certificate in Islamic Finance Qualification.

In the area of public mergers and acquisitions, Soo Ching has advised in many landmark take-over transactions on public companies listed on Bursa Securities including a take-over and subsequent privatisation of a family-owned property development company and in the area of private mergers and acquisitions she has acted for various private equity/venture capital funds on their investments into investee companies by way of purchase of shares from existing shareholders and/or injection of new capital by way of subscription of new shares. She also advised private equity/venture capital funds on exits by way of trade sales, IPOs or reverse take-over into public companies.

On capital market transactions, she has advised companies on IPOs on various bourses including Bursa Malaysia Securities Berhad and Singapore Exchange Ltd. In addition, she has also advised public companies on their fund raising exercises which include rights issue of shares/ loan stocks and private placements.

Soo Ching has also been advising general partners of private equity/venture capital funds with setting up of funds in Malaysia and offshores which includes drafting and negotiating on transaction documents between the general partners and their investors.

Her banking and financing experience includes acting for lenders and major corporations on various domestic and international financing transactions including direct and syndicated loans, project financing and mergers and acquisitions financing. -

Nor Fazlina Mohd Ghouse, TEP, Chief Executive Officer, Maybank Trustees Berhad

Nor Fazlina Mohd Ghouse, TEP, Chief Executive Officer, Maybank Trustees Berhad

Nor Fazlina Mohd Ghouse, TEP is the Chief Executive Officer of Maybank Trustees Berhad, where she leads trustee services for individuals and corporates while driving strategic transformation. She is also a founding committee member and current Secretary of STEP Malaysia, a global professional body dedicated to helping families plan, protect, and transition wealth across generations.With more than 20 years of experience in private banking, trusts, fiduciary services, and family office solutions, Fazlina has advised UHNW and HNW families across Labuan, Jersey, the UK, and Singapore. She is known for crafting bespoke wealth transfer strategies and sustainable family office structures that preserve legacies for the long term. -

Chee Pei Pei, SEA T&L Deloitte Private Leader & Korean Service Group Leader, Executive Director Business Tax Services, Deloitte Malaysia Tax Services

Chee Pei Pei, SEA T&L Deloitte Private Leader & Korean Service Group Leader, Executive Director Business Tax Services, Deloitte Malaysia Tax Services

Pei Pei is currently the Leader for Deloitte Private in Malaysia serving business owners, family groups and high net worth individuals in areas including succession planning, international tax, estate planning and wealth preservation.

Prior to joining Deloitte in 2012, Pei Pei has led the Global Employer Services in another big four firm. She has more than 30 years of work experience at Deloitte and other Big Four organisations in Malaysia and Australia. She has led a wide range of projects related to individual taxation, employment and compensation structuring, advising high net worth individuals and advising clients on financial investment products like private equity funds via limited partnership. She also advises family owners on tax considerations in corporate restructuring as well as tax restructuring for succession planning, including the setting up of Labuan Foundation.

Pei Pei also has extensive corporate tax experience covering aspects of corporate tax advisory services including group tax planning, tax due diligence review for mergers & acquisitions as well as corporate tax restructuring for inbound and outbound investments.

She also leads the Deloitte Malaysia’s tax practice on FATCA and CRS projects. Pei Pei is the engagement partner for FATCA and CRS implementation services to a number of Malaysian banking groups, investment banking group and asset managers.

She also a frequent guest speaker at various events and briefings on topics relating to CRS implications on investors and tax implications on wealth planning conducted by private bankers and high net worth individuals.

Pei Pei graduated with a Bachelor of Management (majoring in Finance and Accounting) from Universiti Sains Malaysia. She is a licensed tax agent and is a member of Chartered Tax Institute of Malaysia (CTIM). -

Doreen Fadli, Head, Business Policy and Tax Development, Labuan Financial Services Authority

Doreen Fadli, Head, Business Policy and Tax Development, Labuan Financial Services Authority

Doreen is the Head of Business Policy and Tax Development at Labuan FSA. She is responsible for the formulation of developmental policies to promote businesses in Labuan IBFC. She is also on the insurance and risk assessment task forces at the authority. Prior to joining the business policy unit, she was head of the licensing department there.

Doreen is a member of the Malaysian Institute of Accountants, CA (M), an Associate Member of The Malaysian Insurance Institute and Member of the Asian Institute of Chartered Bankers. She holds an MBA from Universiti Malaysia Sabah and a Bachelor of Accountancy with Honours from Universiti Teknologi Mara. She also holds certificates in AML/CFT and a Diploma in MII. -

Lim Cheng Bock, Founding Partner, Messrs Bock & Partners

Lim Cheng Bock, Founding Partner, Messrs Bock & Partners

Bock obtained his Law degree from the University of Kent, Canterbury, England in 1985. He was subsequently called to the English Bar in 1986. He has been in continuous practice since 1987 after he was called to the Malaysian Bar. With close to 40 years in practice, he is a highly experienced corporate lawyer. In July 2018, Bock along with his two partners from his previous legal practice, Ms Yap Lay Hoon and Ms Sharmini Ganeshan, founded the firm of Bock & Partners which specialises in corporate and conveyancing law.

Date :

4 November 2025

(Tuesday)

Time :

1000AM - 1230PM

Address :

Aloft KL Sentral

5, Jalan Stesen Sentral,

Kuala Lumpur, Malaysia